Do blockchains even have strategies?

Lets bring situational awareness to the blockchain industry

As a business, investor, or even just a solo-developer working in the blockchain space, it is crucial to think smartly about where we invest our time.

You don't have to spend much time on crypto twitter to realize that we base many of the decisions we make daily on emotions. Doing this is in itself not surprising since we have invested time in learning and building on our chosen chain.

Blockchain maximalist tendencies are very similar to programming language wars or Android vs. iOS. What makes it even harder to think clearly, is that many in the industry have also invested actual money in the underlying token.

It is very important though for everyone in this industry to develop some level of situational awareness of the blockchain industry and develop strategies for your own business, your career and even helping you push through change in your favorite blockchain.

Blockchains are decentralized and leaderless, how can they have a strategy?

Most of the most prominent blockchains are in theory leaderless. That does not mean they have no direction. Communities built this direction through a joint mission, culture, tradition, and lore that has been built up over time.

These qualities are admirable for an ongoing decentralized protocol, but also in particular present often massive opportunities from inertia from stakeholders similar to those seen in large profitable communities.

Overcoming Inertia

Many leading tech companies historically, went to irrelevancy almost overnight. The more profitable and successful, the easier it became to them have strong organizational inertia against the new technical changes disrupting their industries.

The Harvard Business School professor Clayton Christensen calls the phenomena The Innovator's Dilemma and is well understood now by most investors and leaders in Silicon Valley, but rarely discussed in blockchain circles.

A few profitable ones such as Apple, MSFT, and IBM were all close to irrelevancy due to this inertia from significant stakeholders (employees, product groups, and investors). Strong leadership in the above three forced disruptive change to their business, which ultimately made them stronger and survived.

Others like previous giants like Digital Equipment, SUN and Kodak mostly disappeared either through acquisitions or bankruptcy.

People like to use examples of venerable tech companies disappearing like this. But many early leaders in the technology adoption curve also go through this process, only more rapidly. This process often happens as the technology started crossing the chasm.

My alma mater AltaVista is a good example. I was the corporate webmaster during 1996, when we attempted to turn a research project into a business. As the undisputed leaders of internet search in the 90s, the leadership had a certain arrogance about the value of its tech and market position. Google very quickly lept by them, in a year or two AltaVista was irrelevant.

Can successful decentralized projects disrupt themselves?

How can this process be driven in decentralized projects, is complicated. Since the blockchain industry is new, I don't know of good clear examples of groups that have done this. That doesn't mean it can't happen.

Culture and ultimately, the power of individual types of stakeholders can hopefully drive necessary changes, but we have already seen the difficulty of innovation in Bitcoin. Major stakeholders like the core team, miners and large early investors have all fought and are still fighting to avoid disrupting their particular positions.

There are great tools for analyzing and driving Strategy

So what can we do to think clearly about the space and avoid always being driven by emotions?

The traditional non-decentralized business world has lots of tools and ideas that are used to analyze businesses and their strategy.

Sometimes these are used internally to figure out the right next steps in the current competitive climate. It is also good practice to analyze your competitors' strategies.

Some of the tools and ideas I will be using in this newsletter for making sense of blockchains are:

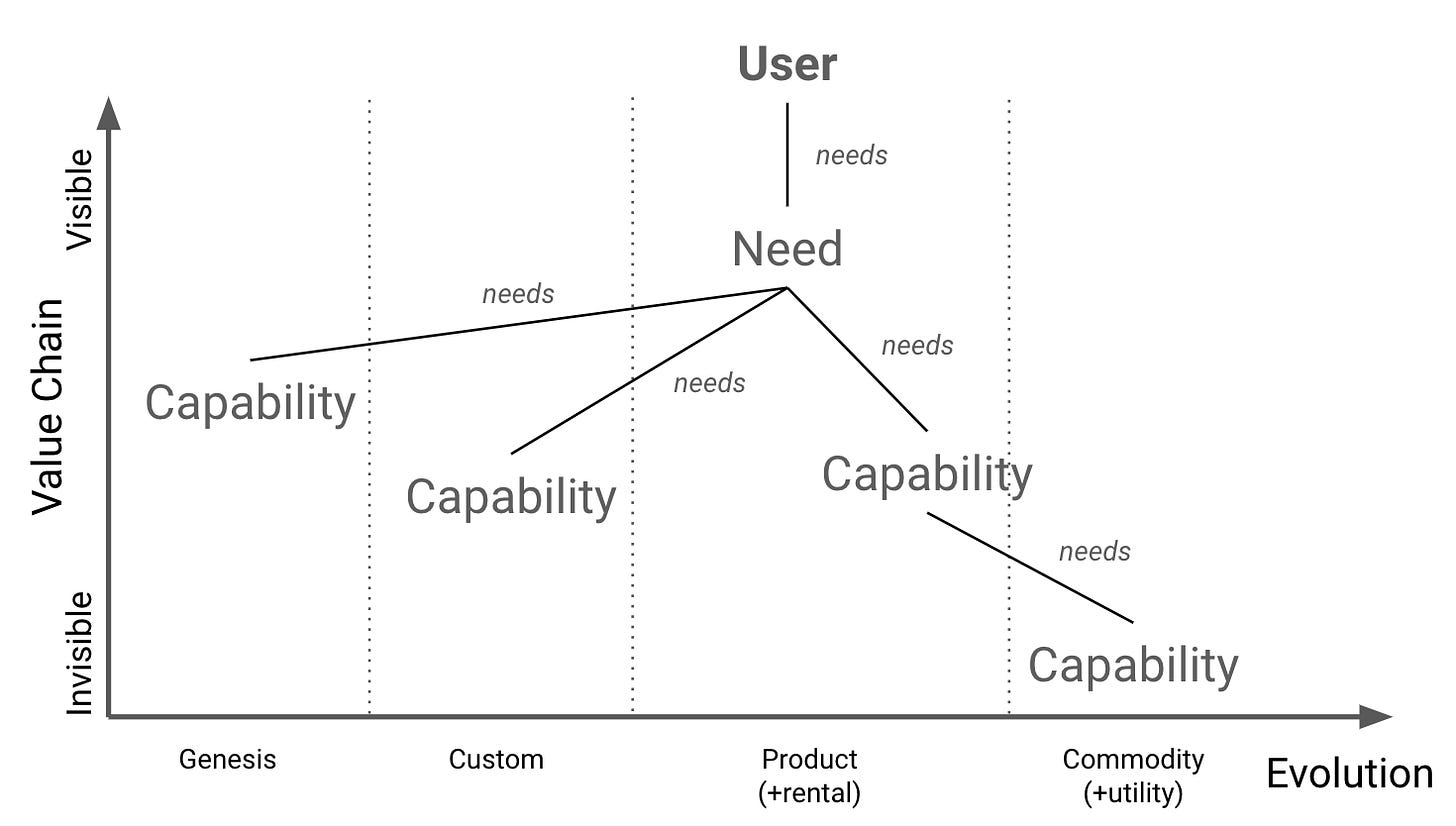

In particular, I plan to use Wardley Maps to visualize my thoughts about specific chains and protocols. I find them useful for making sense of businesses and platforms from a strategic point of view. I recommend this short intro to Wardley Maps by their inventor Simon Wardley.

Whats Next?

My first in-depth analysis will be on my own favorite blockchain Ethereum. I will do my very best to filter my own biases and look at the significant risks and inertia that I believe are facing it. I'll also look at ways to potential ways to mitigate these risks and turn them to our benefit.

Please do subscribe to continue receiving these articles.