In this article, I will analyze some of the major movements for Ethereum over the next year or two. I think there is a general agreement around the moves I will outline. My opinions on the likelihood of the success of them and inertia from stakeholders may prove a bit controversial.

In the previous article, I presented two different Wardley maps of Ethereum 1.0 as I see the ecosystem right now. One was a high-level map of its capabilities and the second a more detailed map of the interactions and interdependencies of the different stakeholders.

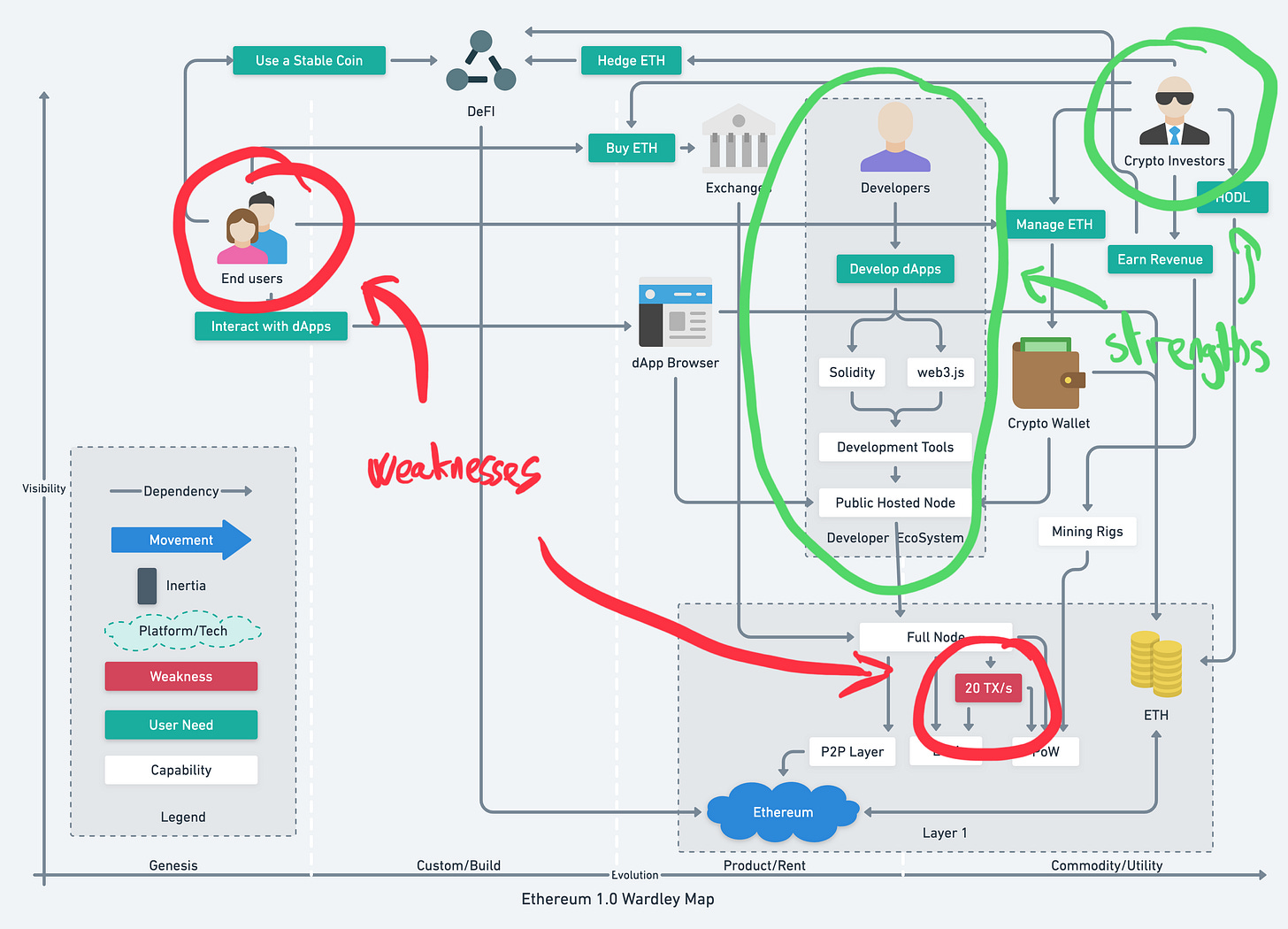

Strength and Weaknesses

Before we address potential movements, let us first revisit the high-level map and look at Ethereum's greatest strengths and weaknesses.

Its greatest strength is, without a doubt, its Developer Ecosystem. I also include its loyal group of Crypto Investors as a significant yet secondary strength.

Its most significant weakness is transaction speed. In a twitter conversation, people rightly suggested that transactions per second is not the correct way of measuring this, so I'll use it a placeholder. The 20tx/s I have here is also not exact.

The other significant weakness of Ethereum is the lack of end-users from outside of the ecosystem. When I say from outside the ecosystem, I mean non-developers and non-investors using Ethereum dApps.

I believe all the above to be non-controversial, but wanted to highlight these first as most initiatives towards movement in the Ethereum space is towards improving the weaknesses listed.

The strengths are also essential to keep in mind. Hopefully, they will help the movement forward, but there is also a significant risk that these strengths could cause inertia halting the forward progress.

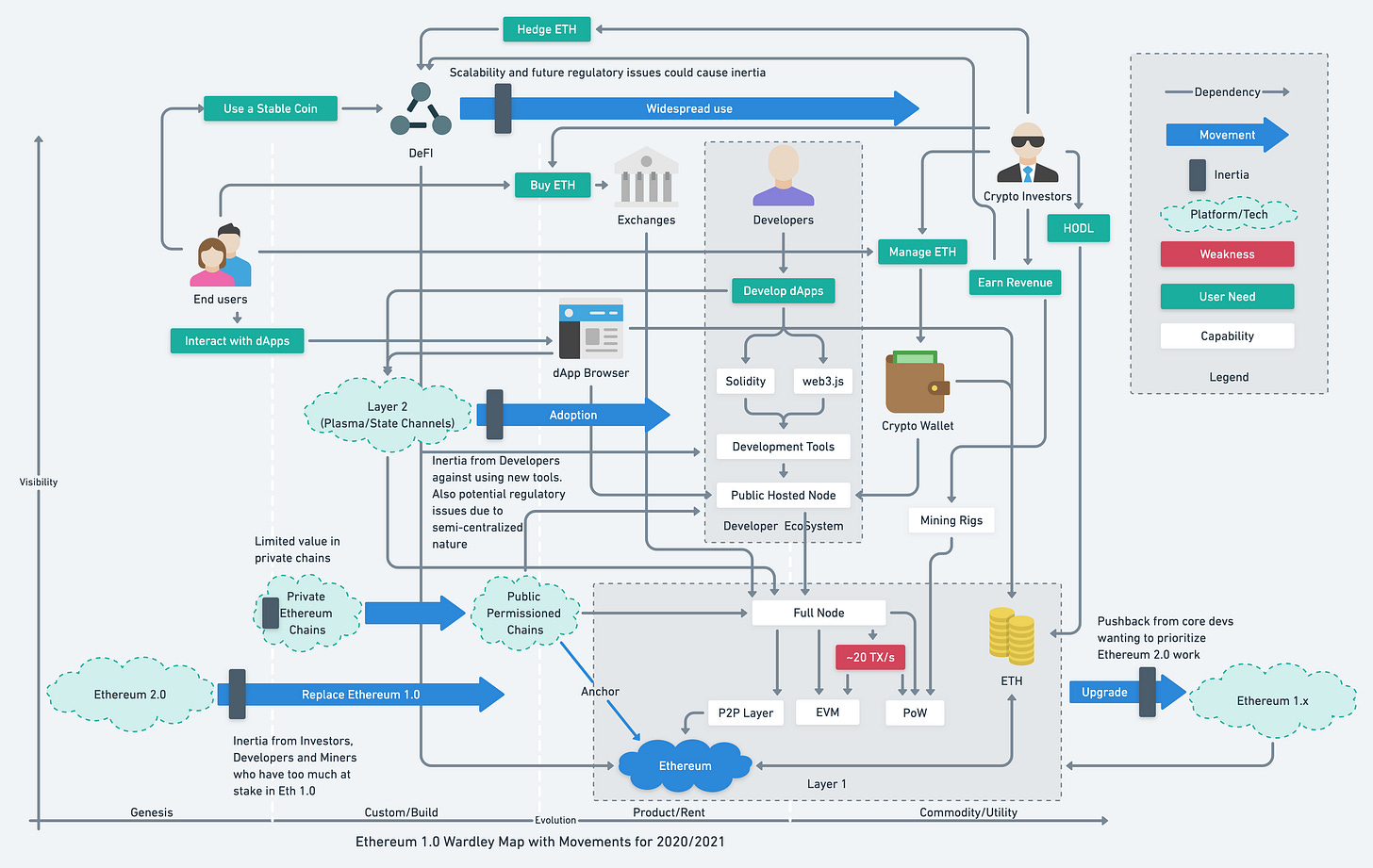

Movements

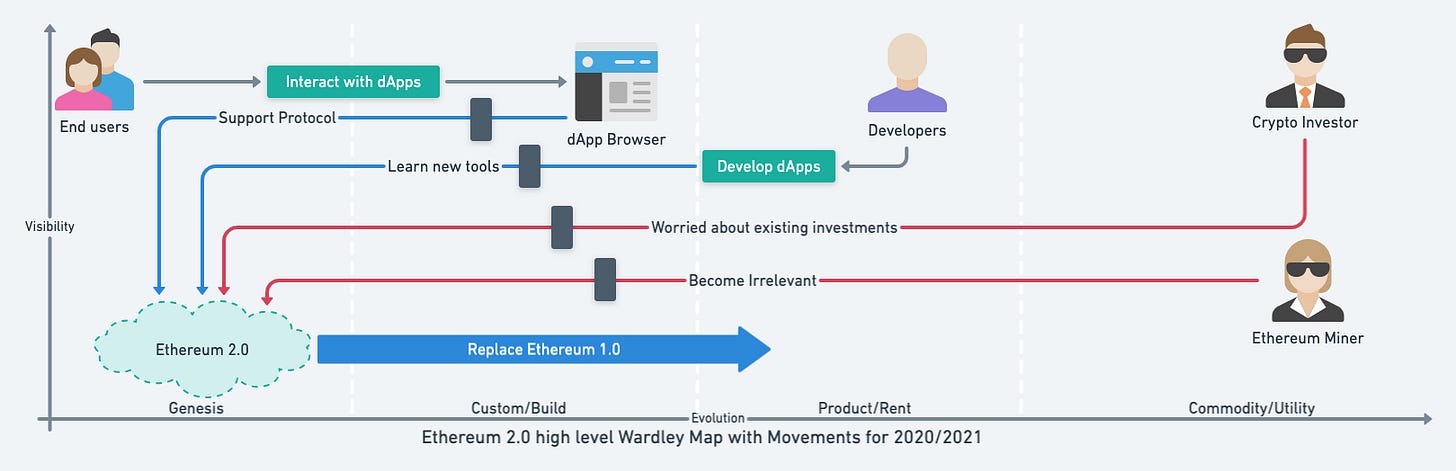

In the following map, I've highlighted what I see as the most significant movements going forward using thick blue lines.

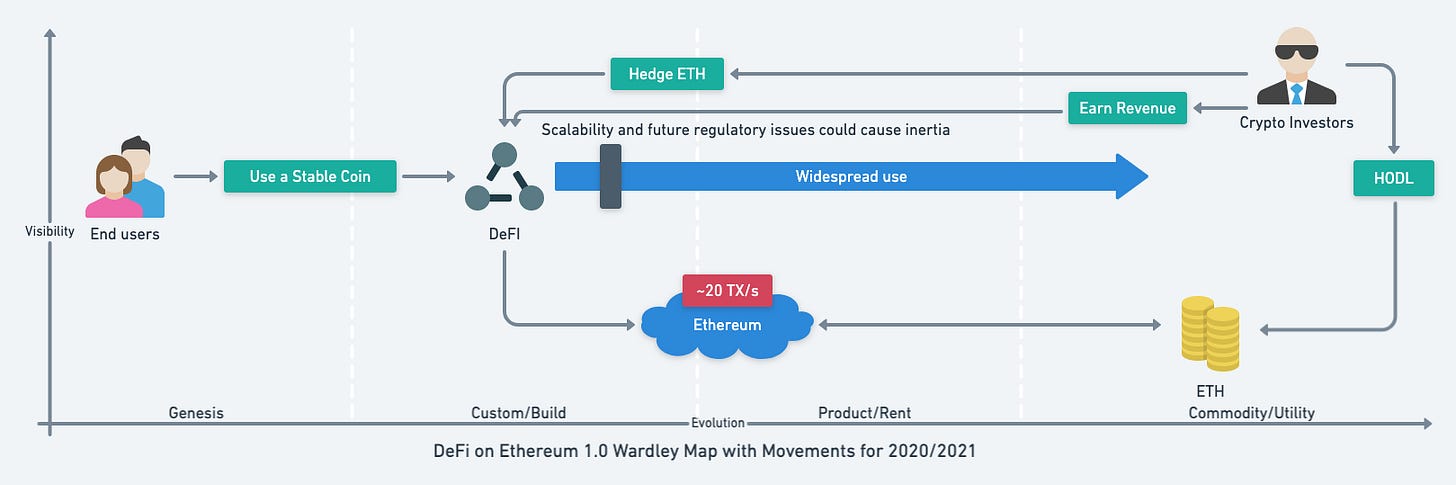

The growth of Decentralized Finance (DeFi)

There is rightfully a lot of excitement about the DeFi market. It solves many of the same problems for crypto investors that the traditional money market does for traditional Investors.

Contrary to popular storytelling, there is still no widespread use of DeFi for consumer or business lending. It allows investors to earn revenue on their Eth holdings and even enable them to hedge their Eth positions.

That said there is a strong hypothesis that stable coins like DAI backed by the leading DeFi platform MakerDAO could make onboarding of regular users easier in the future.

I want to highlight a few areas of potential inertia.

The overall speed of the underlying Ethereum network is a limiting factor to the growth of the market. Layer 2 solutions could solve this.

We've already seen how the XDAI side chain has enabled successful small experiments in e-commerce using the XDAI Burner Wallet.

The other risk I see for inertia is that many DeFi projects rely on centralized price oracles or order books. There could be attempts to regulate these from securities or commodities regulators.

Finally, the nature of DeFi platforms makes it vulnerable to systemic risk. There is so much Eth locked up in novel instruments, that we should expect one or more financial or security black swan events. These could set the industry back a year or two.

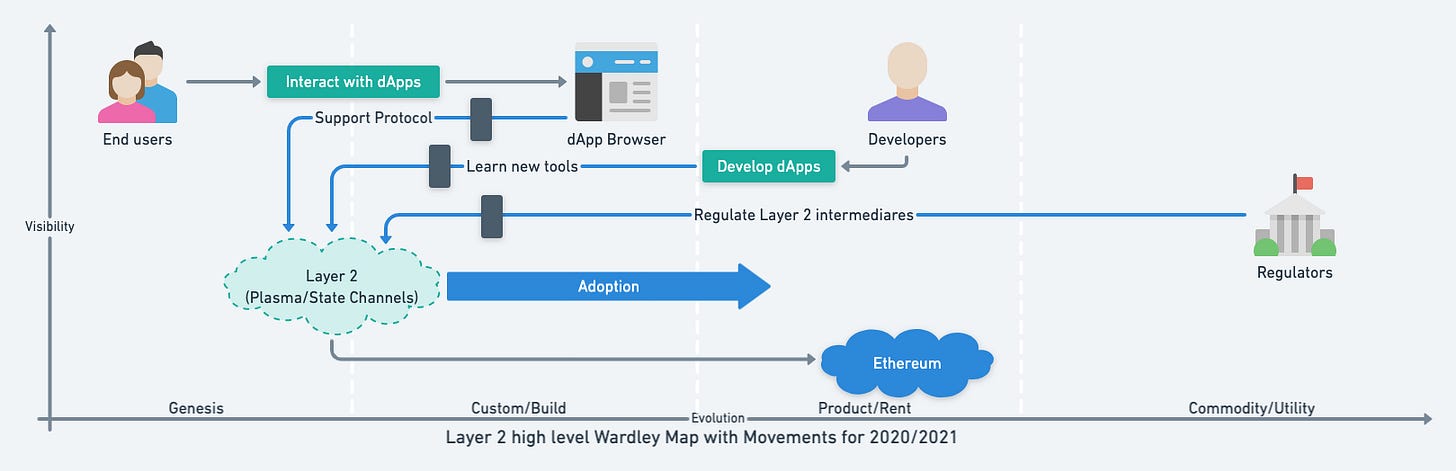

Layer 2

There are many kinds of Layer 2 technologies. Generally, they work by locking up Eth or Tokens in a smart contract on Layer 1 and facilitate movement through some other cryptographically secure mechanism, that ultimate settles on Layer 1.

The most often described forms of Layer 2 technologies you hear about are:

Plasma

State Channels

Sidechains

The whole area is so diverse and complex with lots of movement happening that it deserves it's own article(s). So I will not go into detail here about the differences between the above nor their specific implementations.

Each of the above Layer 2 technologies has the potential to solve the scalability of Ethereum. In particular, payments could be improved by these.

A specific type of State Channels known as Generalized State Channels can also enable large scale throughput of more complicated applications such as games or even new kinds of DeFi projects. See Counterfactual to learn more.

The only real limiting factor from a scalability point of view is onboarding and settlement transactions. As specific platforms grow, this may not end up being necessary, as users may end up leaving their funds on the platform.

There is a lot of progress happening today here, and we already see sizable growth in the amounts of transactions processed.

Primary causes of inertia in the movement to Layer 2 is that developers need to use new tools. Each particular kind of Layer 2 network has it's own APIs and development tools. dApp browsers and wallets will, in many cases, also need to adopt these to improve user experience.

A final lesser appreciated risk is that many of the Layer 2 protocols require an intermediary service such as a relayer or validator. Regulators are still catching up on the technology, and have not made guidance yet on these. Looking at past guidance and existing regulation, it is realistic to expect that regulators would classify some of them as Virtual Asset Service Providers (VASPs) or Money Transmitters in the future.

With this comes requirements for KYC, (in the US state by state registration), reporting requirements and most likely require exchanging KYC information with other VASPs (AKA the FATF Travel Rule).

Work should be done together with experts in the field on designing Layer 2 protocols to minimize the above regulatory risk, or it could end up a major limiting factor.

Ethereum 2.0

All eyes are on Ethereum 2.0 right now. Progress is finally being made on Phase 0 and in general, it sounds like a fantastic architecture.

It promises a combination of Proof of Stake (POS) and Sharding to improve the speed of Ethereum dramatically.

When working on new technological platforms, it is important to be able not to be held back by interoperability with legacy systems.

Therein lies Ethereum 2.0's strength, but also its greatest weakness. In reality, Ethereum 2.0 has very little in common with Ethereum 1.0. Yes, the Ethereum Foundation is funding it, and Vitalik is actively involved. But that is it.

There is the promise of Ethereum 1.x becoming a shard in Ethereum 2.0 as part of Phase 2, which is not likely before 2022.

I think there will be high levels of inertia against the adoption of Ethereum 2.0 from the existing Ethereum community.

Developers will have to learn entirely new tools

Miners will no longer have a role

The success of DeFi platforms may slow adoption until Ethereum 1.x becomes a shard on 2.0

Crypto Investors will be risk-averse against final hard forks integrating the two projects

As part of Phase 2, Crypto Investors holding ETH will be able to move it to a new ETH2 token on the Ethereum 2.0 beacon chain. ETH2 will let you stake and earn income.

These funds will be "stuck" in ETH2 until phase 2 is released, as it is a one-way process. You could probably still use custodial exchanges to transfer funds back to the ETH 1.0 world to access DeFi products.

One of my principal worries with Ethereum 2.0 is, is it too little too late?

There are other competing POS/sharded chains such as Cosmos and Polkadot. They are objectively much further ahead than Ethereum 2.0 and could be seen as less risky than Ethereum 2.0 by major Ethereum stakeholders. Add the inertia from existing Ethereum 1.0 stakeholders towards 2.0, and it looks even more worrying.

Ethereum 1.x

Work hasn't stopped on improving the Ethereum 1.0 chain. Hopefully, the next hard forks (Istanbul 1 and 2) will be released this year.

But a lot more work is being done to improve Ethereum 1.0 over the next year or two. These future hard forks could provide slight speed improvements as well as lower the cost of running full nodes.

There is already controversy about some of the more drastic improvements proposed.

This kind of inertia is typical within successful blockchains.

Many people are heavily invested in Eth, DeFi, and underlying tokens. They are now highly risk-averse against any changes to the underlying network.

Permissioned chains

The final move that has already been going on, albeit slowly is businesses using permissioned Ethereum chains.

We have seen quite a few POC's over the last few years, but these projects are now starting to be treated as MVPs or even production in a few cases.

Early on, large enterprises were worried about using public infrastructure, so they mostly experienced with small private chains. Often internally or in small consortia.

Many businesses have now learned more about what is possible. We see a trend away from smaller consortia chains towards consortia applications deployed on public permissioned chains.

Public Permissioned chains typically use Quorum, Geth or Pantheon using Proof of Authority consensus protocols.

These are typically designed to be similar to an Ethereum mainnet in that many different applications can live on the same chain and interoperate.

Most are typically promoted for use within a region. Two examples are Alastria from Spain and the new LACChain project from the Interamerican Development Bank for Latin America.

These are still permissioned chains, where nodes are permissioned, and end-users are verified through established Identity Verification standards.

The reason Ethereum based permissioned networks are taking off over others, is because of the large Developer Ecosystem. Any Ethereum developer can take their Solidity smart contracts and deploy them using the same tools to these chains.

How can you act?

I realize that all the talk in this article about inertia sounds less than optimistic. However, if we recognize and accept it exists or even that it might happen, we can find solutions around it.

Layer 2 technology is incredibly exciting and should help us going forward. The internal inertia such as learning new tools, is not insignificant but can be overcome.

I would be interested in other peoples analysis about these issues as well.

My next article will probably about UX and development patterns in blockchain applications. If you haven’t already subscribed, please hit the Subscribe button below.

If you're at Berlin blockchain week and see me, say hi.